tempe az sales tax rate 2020

Increased to 300 effective January 1 2003. Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725.

What S The Arizona Tax Rate Credit Karma Tax

Arizona has 511 special sales tax jurisdictions with local sales taxes in.

. However please note that tax rate changes do not necessarily occur every month. Tempe AZ 85280 salestaxtempegov. Wayfair Inc affect Arizona.

Combined Privilege Tax Rates. Closed or No Sales. 2020 rates included for use while preparing your income tax deduction.

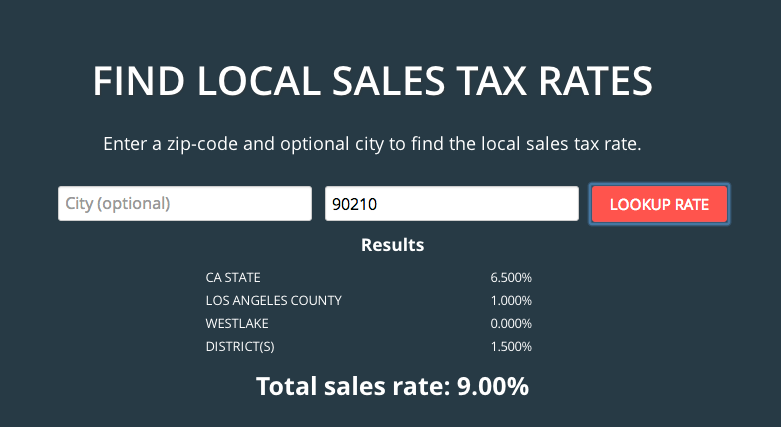

The Arizona sales tax rate is currently. For tax rates in other cities see Arizona sales taxes by city and county. The Tempe sales tax rate is.

Failing to do so will result in a 25 penalty from ADOR. The latest sales tax rate for tempe junction az. Average Sales Tax With Local.

Tempe Junction AZ Sales Tax Rate. As of 2020 the current county sales tax rates range from 025 to 2. 2020 Arizona State Sales Tax Rates The list below details the localities in Arizona with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

The minimum combined 2022 sales tax rate for Tempe Arizona is. 2 The Maricopa County transient lodging rate of 177 includes 1 per Prop. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223.

This tax does not apply to. What is the sales tax rate in Tempe Arizona. You can print a 86 sales tax table here.

Select the Arizona city from the list of popular cities below to see its current sales tax rate. Even if you had no sales andor tax due for a filing period you must still file a 0 TPT return on AZTaxesgov. 2020 Arizona Sales Tax Rates The following are a breakdown of the Retail Sales Tax Rates for most of the major cities in the Phoenix metro area.

Did South Dakota v. File Pay TPT Monthly AZTaxesgov. This is the total of state county and city sales tax rates.

The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. As Of July 1 2014. There is no applicable special tax.

20 Use Taxable Purchases 18 56 74. There is a minimum of 25 and a maximum 25 percent of the tax due or 100 per return whichever is greater. Not Taxed By State County MCTC Section 445.

The County sales tax rate is. Arizona Hospitality Research and Resource Center AHRRC Revised January 2020 3 Transient lodging in unincorporated areas of Pima County is subject to a 6 county tax effective 1106. City Hall 31 E.

Tempe 250 560 Tolleson 320 560 Wickenburg 290 560 Youngtown 370 560 Pinal County Local General Sales Tax AZ State Sales Tax. Apply for TPT License. The state sales tax rate in Arizona is 5600.

If this rate has been updated locally please contact us and we will update the sales tax rate for Tempe Arizona. No School No School. The 86 sales tax rate in Phoenix consists of 56 Arizona state sales tax 07 Maricopa County sales tax and 23 Phoenix tax.

Business codes region codes and city codes can be found on the tax rate table. Arizona has recent rate changes Wed Jan 01 2020. 5th st tempe az 85281 p.

Impose an additional 200 bed tax. TPT Rate Table - June 2022. With local taxes the total sales tax rate is between 5600 and 11200.

6 rows The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and. Groceries and prescription drugs are exempt from the Arizona sales tax. The tempe sales tax is collected by the merchant on all qualifying sales made within tempe.

The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for 202223. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. The minimum combined 2021 sales tax rate for tempe arizona is 81.

Counties in Arizona collect an average of 072 of a propertys assesed fair market value as property tax per year. City of Tempe Maricopa County Arizona State. Sales of food for home consumption will be taxed a different rate effective July 01 2010.

The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000. TPT and Other Tax Rate Tables are updated monthly. Arizona is ranked number thirty one out of the fifty states in order of the average amount of property taxes collected.

The rate will 180. Arizona has state sales tax of 56 and. Modify Section 16-460a entitled Retail Sales.

Apply or Renew on the Accela Citizen AccessACA Portal. The current total local sales tax rate in Tempe. 4 rows The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07.

Sales tax in Tempe Arizona is currently 81. However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License.

Do This To Save 16 On Every Marijuana Purchase In Arizona

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Arizona Sales Tax Small Business Guide Truic

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Sales Tax Rates By City County 2022

Rate And Code Updates Arizona Department Of Revenue

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Residential Commercial Rentals City Of Tempe Az

Is Food Taxable In Arizona Taxjar

How To Collect Sales Tax Through Square Taxjar

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona Sales Tax Small Business Guide Truic

Commercial Tree Services Top Leaf Tree Service Tree Service Tree Removal Arizona